NZ GST101A 2017-2024 free printable template

Show details

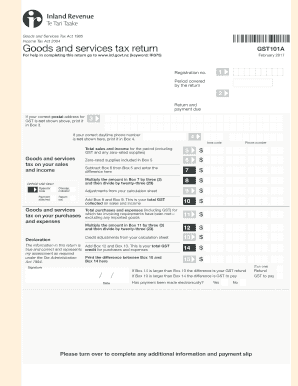

Goods and Services Tax Act 1985Goods and services tax returnGST101AFor help in completing this return go to www.ird.govt.nz (keyword: IR375)May 2017Registration no.1Period covered

by the return2

Return

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your gst return form 2017-2024 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst return form 2017-2024 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst return form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gst101a form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

NZ GST101A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out gst return form 2017-2024

How to fill out gst101a

01

To fill out GST101A form, follow these steps:

1. Begin by entering your personal information in the designated sections such as your name, address, and social security number.

2. Provide details about your business such as the name, address, and GST registration number.

3. Fill out the summary section by reporting the total taxable supplies made during the reporting period.

4. Report the GST/HST collected during the reporting period in the appropriate sections.

5. Enter any GST/HST adjustments or rebates in the corresponding sections.

6. Calculate the net tax amount payable or refundable.

7. Sign and date the form before submitting it to the relevant tax authority.

Who needs gst101a?

01

GST101A is needed by individuals or businesses who are registered for GST (Goods and Services Tax) or HST (Harmonized Sales Tax). This form is used for reporting and remitting the GST/HST collected on taxable supplies made during a reporting period. It is required by the tax authorities to ensure compliance with taxation regulations and to calculate the net tax amount payable or refundable.

Video instructions and help with filling out and completing gst return form

Instructions and Help about gst101a form edit

Fill gst 101a printable form : Try Risk Free

People Also Ask about gst return form

What is use of English GNS 101?

Is the term used to describe the process of screening through a passage in a very rapid manner in order to locate a vital information?

What is GST 101 all about?

What is communication in English course?

What is GST 102 use of English?

What is noun communication in English?

What is GST 101 summary?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gst101a?

GST101a is a course offered by the Canada Revenue Agency (CRA) that provides an introduction to the Goods and Services Tax/Harmonized Sales Tax (GST/HST) system. The course provides an overview of the GST/HST, including the registration process, filing requirements, reporting obligations and other important topics.

Who is required to file gst101a?

The GST101A return is a periodic report of taxes collected and remitted to the Canada Revenue Agency (CRA) and is required to be filed by all GST/HST registrants.

How to fill out gst101a?

1. Download the GST101A form from the Canada Revenue Agency (CRA) website.

2. Enter your business information including the business name, address, and GST/HST number.

3. Enter the total amount of GST/HST you are claiming on the form.

4. Enter the total amount of GST/HST collected from your customers.

5. Attach any applicable supporting documents, such as invoices or receipts.

6. Sign and date the form.

7. Submit the form to the CRA along with any applicable payment.

What information must be reported on gst101a?

The GST101A form is used to report the quarterly or annual GST/HST returns for a GST/HST registrant. The form must include information about the sales, purchases, and other activities of the GST/HST registrant, including:

1. The total sales made in the period (including GST/HST collected)

2. The total purchases made in the period (including GST/HST paid)

3. The total GST/HST collected from customers

4. The total GST/HST paid to suppliers

5. The total Input Tax Credits claimed

6. The total GST/HST payable or refundable

7. The total net tax payable or refundable

8. The total instalments paid

9. The total amounts due or to be refunded

10. Any other relevant information, such as input tax credits or rebates.

When is the deadline to file gst101a in 2023?

The deadline for filing GST101A in 2023 is April 30th, 2023.

What is the penalty for the late filing of gst101a?

Penalties for the late filing of a GST101A return can vary depending on the amount of time the return is late. Generally, the penalty is 5% of the amount of GST/HST payable, plus 1% of the amount of GST/HST payable for each full month the return is late, up to a maximum of 12 months.

What is the purpose of gst101a?

Based on the given information, it is not possible to determine the specific purpose of gst101a. "gst101a" could refer to a course, a program, or even a designation, but without further context, the purpose cannot be determined.

How do I edit gst return form in Chrome?

gst101a form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the gst 101a form in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your gst101a form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out gst 101a on an Android device?

Use the pdfFiller app for Android to finish your gst 101 form. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your gst return form 2017-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gst 101a Form is not the form you're looking for?Search for another form here.

Keywords relevant to gst 101 form

Related to gst101a pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.